The Best Guide To Feie Calculator

Table of ContentsThe Basic Principles Of Feie Calculator Fascination About Feie CalculatorThe 6-Second Trick For Feie CalculatorThe Greatest Guide To Feie CalculatorFacts About Feie Calculator Revealed

He marketed his United state home to develop his intent to live abroad completely and applied for a Mexican residency visa with his partner to assist meet the Bona Fide Residency Test. Additionally, Neil secured a long-term residential property lease in Mexico, with plans to eventually purchase a residential property. "I currently have a six-month lease on a residence in Mexico that I can expand one more six months, with the intention to acquire a home down there." Neil aims out that purchasing home abroad can be testing without initial experiencing the place."It's something that people require to be truly thorough about," he claims, and suggests deportees to be careful of usual errors, such as overstaying in the U.S.

Neil is careful to stress to Stress and anxiety tax authorities that "I'm not conducting any business any kind of Organization. The U.S. is one of the couple of nations that tax obligations its residents regardless of where they live, indicating that even if a deportee has no earnings from U.S.

tax returnTax obligation "The Foreign Tax obligation Credit score permits people functioning in high-tax countries like the UK to counter their United state tax responsibility by the amount they have actually already paid in tax obligations abroad," says Lewis.

Not known Details About Feie Calculator

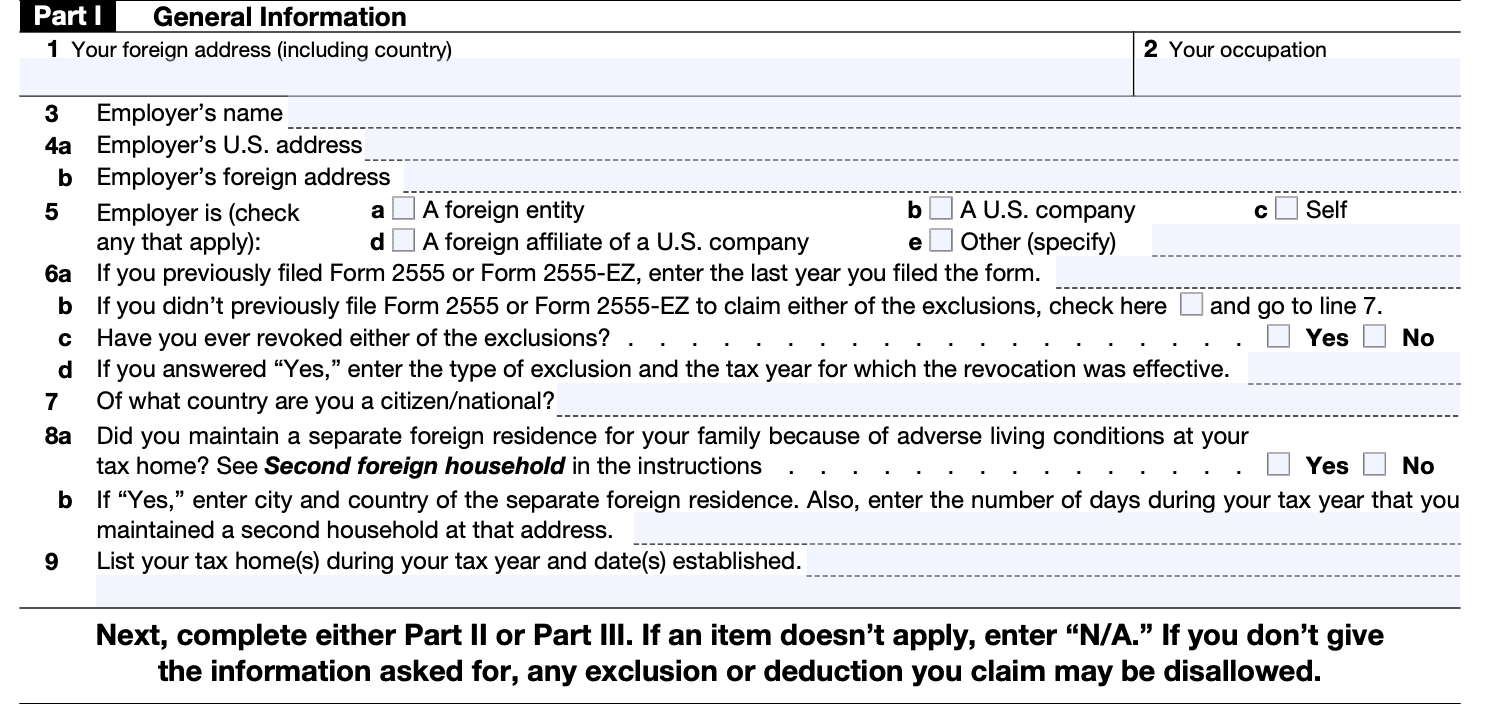

Below are some of the most regularly asked questions about the FEIE and various other exclusions The Foreign Earned Revenue Exemption (FEIE) permits U.S. taxpayers to leave out up to $130,000 of foreign-earned income from federal earnings tax, lowering their U.S. tax liability. To get approved for FEIE, you need to fulfill either the Physical Presence Test (330 days abroad) or the Bona Fide Home Test (verify your main house in an international nation for an entire tax year).

The Physical Presence Test additionally calls for United state taxpayers to have both a foreign income and an international tax obligation home.

Getting My Feie Calculator To Work

An income tax treaty in between the U.S. and one more nation can assist avoid dual tax. While the Foreign Earned Revenue Exemption reduces gross income, a treaty may give added benefits for qualified taxpayers abroad. FBAR (Foreign Savings Account Record) is a needed filing for united state citizens with over $10,000 in international financial accounts.

Eligibility for FEIE depends on meeting specific residency or physical visibility examinations. next He has over thirty years of experience and currently specializes in CFO solutions, equity payment, copyright taxation, cannabis taxes and divorce related tax/financial planning issues. He is a deportee based in Mexico.

The foreign gained earnings exclusions, occasionally referred to as the Sec. 911 exclusions, leave out tax on wages earned from functioning abroad.

Rumored Buzz on Feie Calculator

The income exemption is currently indexed for inflation. The optimal yearly earnings exclusion is $130,000 for 2025. The tax benefit omits the earnings from tax obligation at lower tax obligation rates. Previously, the exemptions "came off the top" minimizing revenue based on tax obligation on top tax rates. The exemptions may or may not lower earnings utilized for various other functions, such as individual retirement account limits, child credit reports, individual exemptions, and so on.

These exclusions do not excuse the incomes from United States taxation however merely provide a tax decrease. Note that a bachelor working abroad for every one of 2025 who gained regarding $145,000 with no various other revenue will have gross income decreased to zero - properly the very same solution as being "free of tax." The exclusions are computed daily.